- Total News Sources

- 2

- Left

- 1

- Center

- 0

- Right

- 1

- Unrated

- 0

- Last Updated

- 93 days ago

- Bias Distribution

- 50% Right

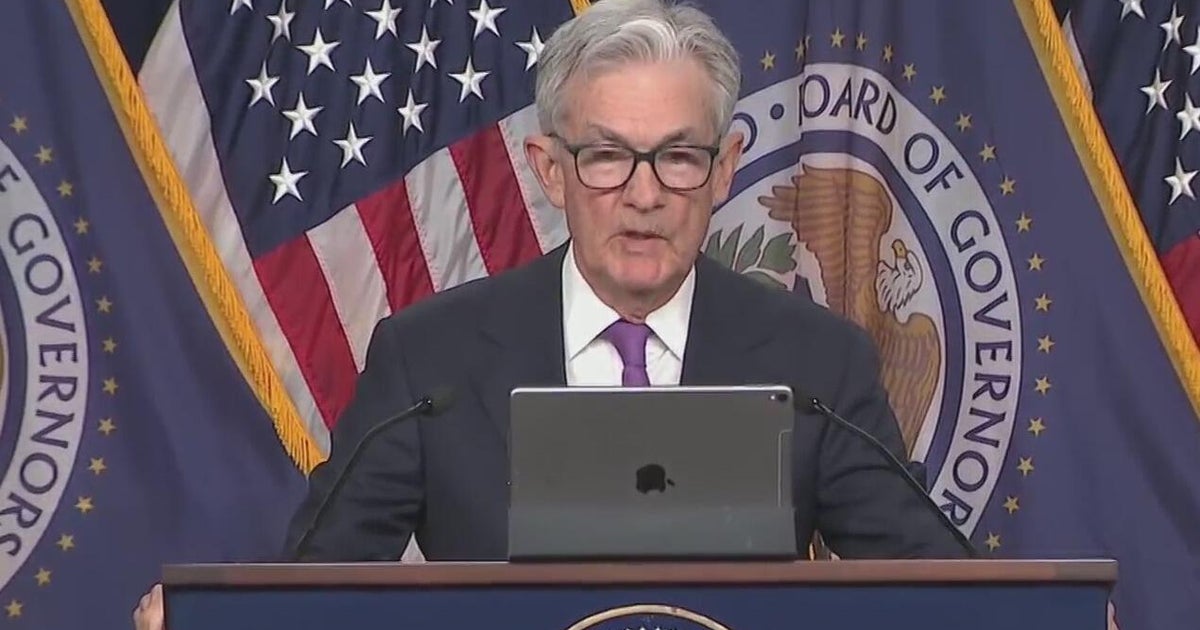

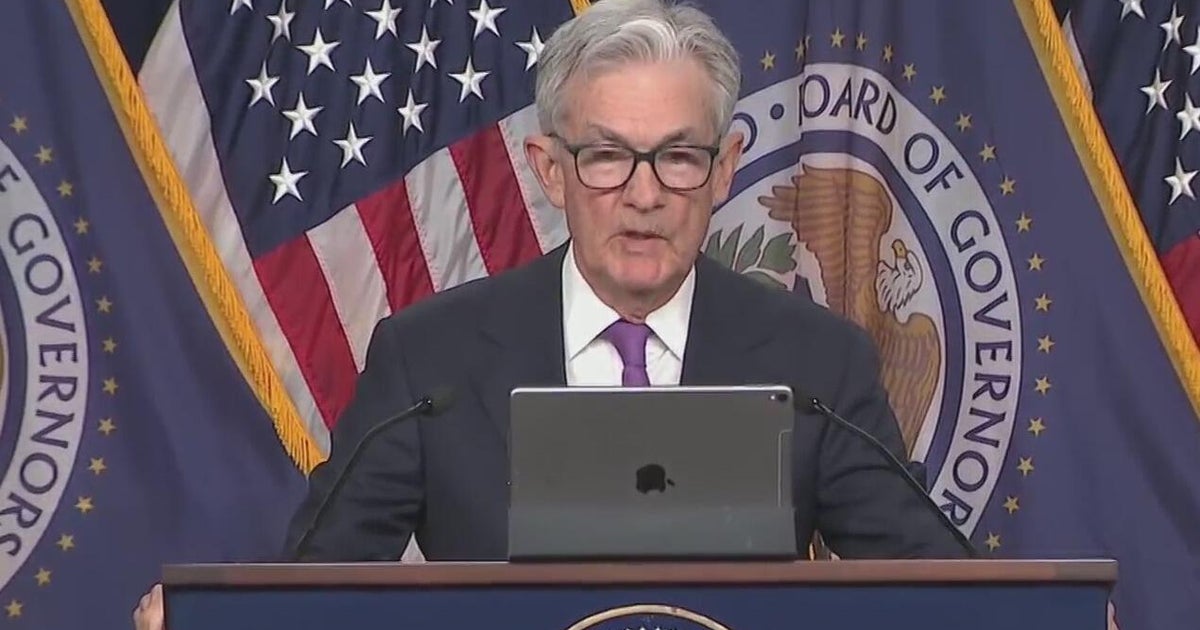

US Federal Reserve Cuts Key Interest Rate to 3.75%-4% Amid Inflation Concerns

In October 2025, the US Federal Reserve, led by Chairman Jerome Powell, lowered its benchmark interest rate by 25 basis points to a range of 3.75% to 4%, marking the second rate cut in six weeks, aiming to support maximum employment amid rising inflation and economic uncertainty. The Federal Open Market Committee (FOMC) highlighted that economic growth remains moderate but noted a slowdown in job gains and a slight increase in unemployment, which nevertheless remains low. Concerns over the labor market and funding tightness prompted the Fed to pause the reduction of its securities holdings starting December. The decision was supported by ten out of twelve committee members, with dissent from members advocating either a larger cut or no change. Fed Chair Powell emphasized that future rate adjustments, including a potential December cut, are data-dependent and not predetermined. The central bank's shift reflects a growing focus on preventing a surge in unemployment while continuing to monitor inflation dynamics amid a challenging economic environment including a government shutdown.

- Total News Sources

- 2

- Left

- 1

- Center

- 0

- Right

- 1

- Unrated

- 0

- Last Updated

- 93 days ago

- Bias Distribution

- 50% Right

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.